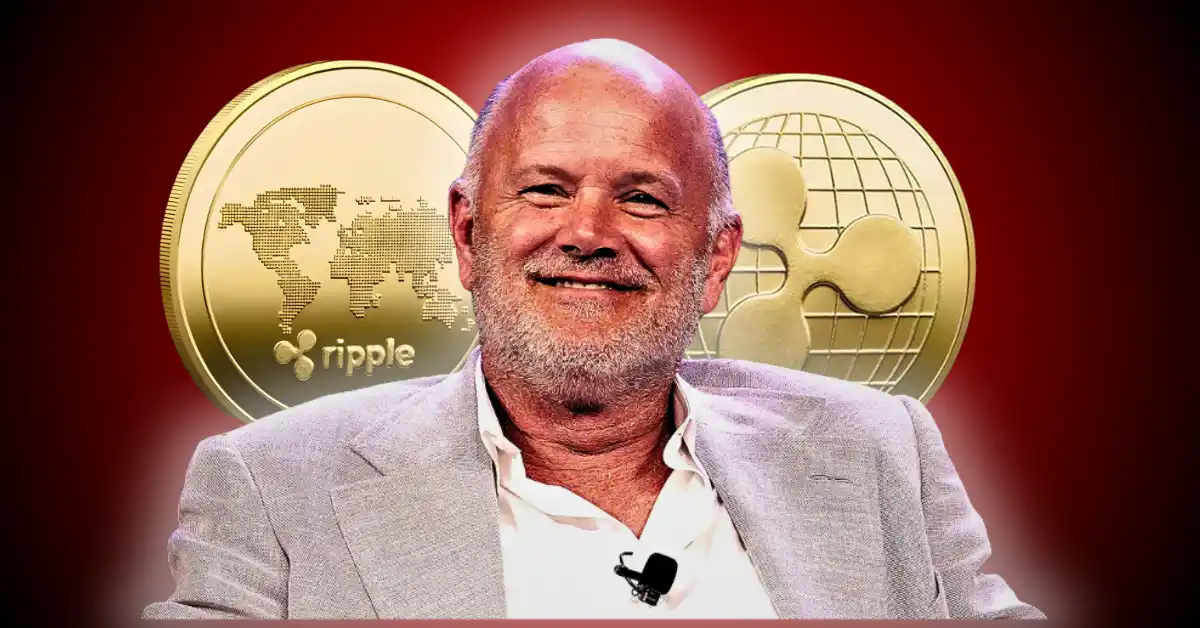

Crypto’s next phase won’t be decided by hype, and Mike Novogratz is making that clear.

The Galaxy Digital CEO says the market is moving away from story-driven tokens and toward projects that can show real use. In a recent Youtube video from Galaxy’s channel titled “2026 is a Year for Building,” Novogratz warned that tokens like XRP and Cardano (ADA) could lose relevance if they fail to prove practical value as the industry matures.

His message was clear: crypto’s next winners will be built on usage.

Novogratz said the market is shifting from “narrative-driven tokens” to “business-driven tokens” – assets that actually do something and can point to adoption, revenue, or visible demand.

That change won’t happen overnight. Instead, he sees a one- to three-year transition period, with 2026 acting as a key checkpoint for the industry.

“I think it’s it is a building year for us and for other crypto companies,” Novogratz said. “It’s time for us to start being important.”

Tokens that remain stuck in vision mode may struggle once the market starts asking harder questions.

Novogratz made a clear distinction between Bitcoin and most altcoins. Bitcoin, he said, functions as a macro asset and long-term hedge. Other tokens, including XRP and ADA, are competing as infrastructure – payment rails, financial tools, or utility networks.

In that environment, speed or decentralization alone isn’t enough. What matters is whether people are actually using the network.

Without visible adoption, Novogratz suggested, those tokens risk being left behind as crypto shifts from trading to real-world application.

Another major theme was convergence. Novogratz expects wallets and exchanges to evolve into full-scale financial platforms offering stablecoins, tokenized assets, and investment products.

“Everyone’s going to try to build a similar business, which is let me give you a bank and a wallet,” he said.

This shift, he added, will take years, but it will reshape how crypto fits into everyday finance.

Novogratz closed with a clear takeaway: the next two years are about building, not marketing.

By 2026, crypto projects will need to show where they matter in the real world or risk fading as the industry grows up.

Not entirely. Short-term trading will still exist, but long-term capital is increasingly flowing toward projects that can justify their value through usage, not momentum alone.

Early-stage altcoin projects, especially those without clear adoption paths, face the most pressure. Established firms with products, users, or institutional ties may benefit.

Projects that fail to demonstrate relevance risk losing developer interest, liquidity, and long-term investor support as the market reallocates capital to proven platforms.

A new theory has been making the rounds online: that Bitcoin is being deliberately pushed…

Bitcoin is approaching one of its most important technical levels in recent weeks as the…

The altcoin rally is firmly back in focus today, as the broader crypto market turns…

After a week of heavy selling, Bitcoin price has finally bounced back strongly, jumping 6%…

Story Highlights The live price of the Tron coin is Tron’s price 2026 target is…

HB 1042 has passed both chambers of the Indiana Legislature and now awaits the signature…