Silver prices have soared this year, making headlines and catching the attention of investors everywhere. The surge is driven by limited supply, growing demand from industries like solar energy and AI data centers, and global economic uncertainty. With prices climbing quickly and markets becoming more volatile, many investors are asking: Is silver rising too fast?

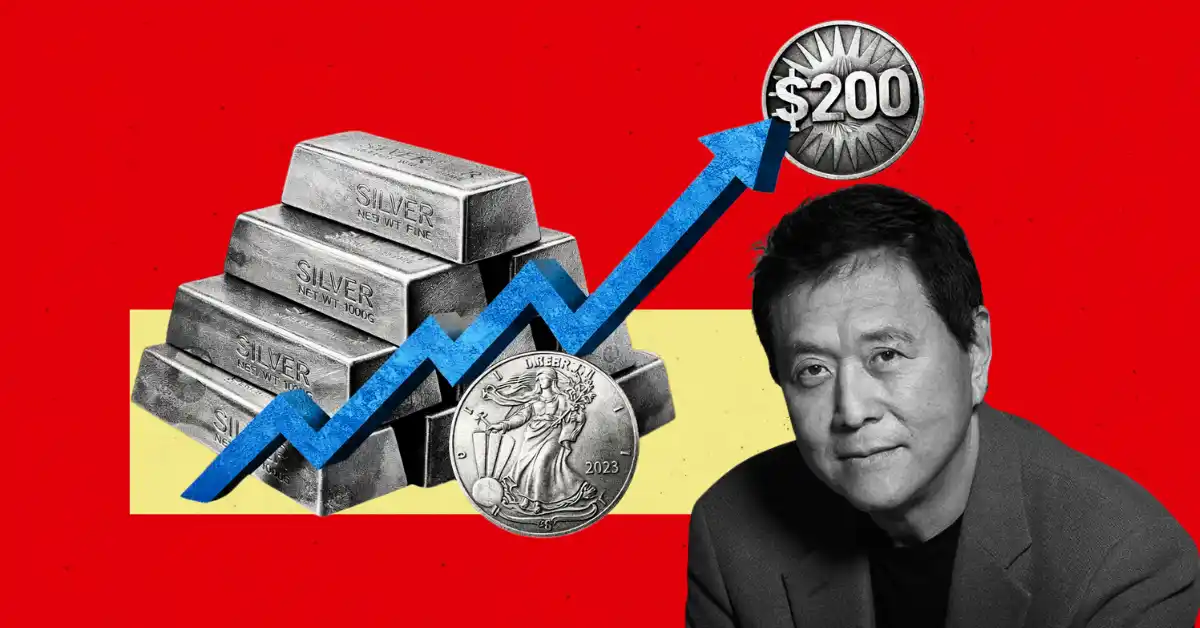

Robert Kiyosaki, author of Rich Dad Poor Dad, has returned to the spotlight with a familiar yet more cautious message. Kiyosaki has backed silver for decades, saying he bought his first silver back in the 1960s. His core belief hasn’t changed. He sees silver as protection against weakening fiat currencies and long-term inflation pressures.

Looking ahead, Kiyosaki still believes silver could push beyond $100 in 2026 and even reach $200 in a more aggressive scenario. However, this time his tone comes with a warning. He is concerned that excitement, not discipline, is starting to drive buying behavior.

Kiyosaki has openly questioned whether silver is entering bubble territory in the short term. He points to the rising fear of missing out, where investors rush in simply because prices are moving higher. History shows this kind of behavior often ends with sharp pullbacks.

Recent market action supports his caution. According to The Kobeissi Letter, silver saw wild swings shortly after futures opened, surging to record highs before dropping sharply within an hour. These violent moves highlight how unstable the market has become and why patience matters more than ever.

Rather than urging people to chase silver at current levels, Kiyosaki advises waiting. In his view, corrections are healthy and often create better opportunities. He repeats one of his most well-known lessons. Profits are made when you buy, not when you sell. Timing and discipline, not hype, define successful investors.

Some analysts believe silver’s surge doesn’t compete with Bitcoin but actually sets the stage for it. Bull Theory points to 2020, when gold and silver rallied first after the COVID crash, while Bitcoin moved sideways. Only after metals peaked did capital rotate into crypto, triggering Bitcoin’s explosive rally.

Today’s setup looks similar. Precious metals are leading again, while Bitcoin remains calm. This time, however, more factors are lining up, including easing monetary conditions, clearer crypto regulations, growing ETF access, and rising institutional participation.

Rapid gains can increase market volatility, leading to sudden price corrections. Investors relying on short-term momentum may face losses if metals retract quickly.

Retail investors and small funds are most exposed, as they may react emotionally to FOMO, while institutional players often hedge or wait for strategic entry points.

Continued industrial demand and limited supply could sustain long-term upward pressure, but short-term pullbacks may create buying opportunities for disciplined investors.

Ethereum plans on implementing Proposer-Builder Separation (ePBS) and Fork-Choice-Enforced Inclusion Lists (FOCIL) within this year’s…

On March 2, Bitcoin (BTC) reclaimed the $69K psychological level after a week of volatility…

Crypto markets turned green today. Bitcoin surged past $68,000 and briefly traded near $69,500, rising…

In a moment few in the crypto industry expected, former SEC Chair Gary Gensler allegedly…

Michael Saylor’s firm Strategy has added 3,015 bitcoins at an average price near $67,700, spending…

Story Highlights The live price of Cronos crypto is . Cronos coin price is expected…