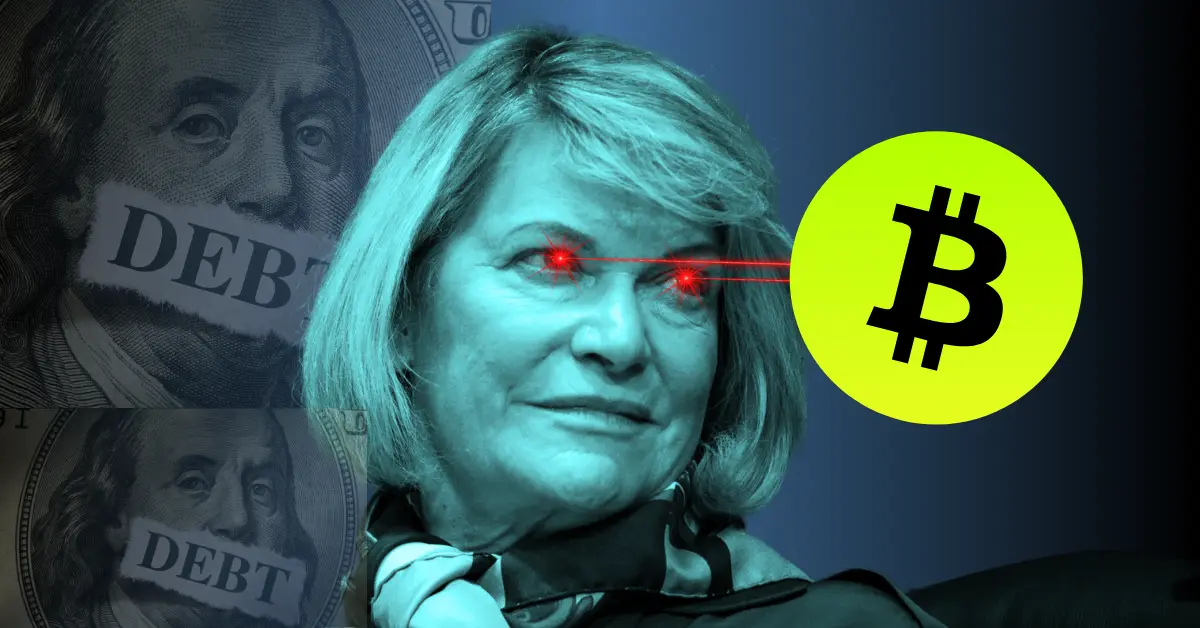

Can Bitcoin help reduce America’s $33 trillion debt? Senator Cynthia Lummis believes it can and she’s outlined a bold plan to make it happen.

In a recent Bloomberg interview, Lummis revealed her proposal to create a U.S. Bitcoin reserve, aiming to secure one million BTC, around 5% of the total supply, over the next 20 years.

Her vision goes beyond investing. It’s about turning Bitcoin into a strategic asset that could reshape the country’s financial future.

Lummis suggested starting the reserve with digital assets already held by the U.S. Marshals Service, specifically from asset forfeiture funds. These funds, some of which are in crypto, could lay the foundation for the first year, without needing new legislation right away.

Still, she acknowledged that clear legal protections would be necessary later on to keep the reserve safe from political shifts.

Lummis stressed that this reserve should focus only on Bitcoin. Why? Because of its proof-of-work mining model, which makes it more secure and reliable compared to other cryptocurrencies.

In her view, Bitcoin stands out as the best choice for a long-term national reserve. The core of Lummis’ plan is to acquire and hold one million Bitcoin over 20 years. She believes that if Bitcoin’s value rises as expected, the U.S. could use the reserve to cut the national debt in half.

Lummis also tied the idea to global strategy, saying a U.S. Bitcoin reserve could be just as important as oil reserves, especially in the ongoing economic rivalry with China.

She mentioned that top U.S. military officials in Southeast Asia back the idea and see Bitcoin as a valuable strategic asset.

Lummis went on to praise President Donald Trump for his early investments in Bitcoin. She called him a forward-thinker when it comes to digital assets and encouraged more Americans to see the value in early crypto adoption.

As the digital economy grows, she believes this mindset will become increasingly important.

If this plan takes off, it could mark a major shift in how the U.S. manages its economy and how Bitcoin is seen as a tool for national strength.

Bitcoin (BTC) price is up nearly 1.6% over the past 24 hours, trading around $68,213,…

Bitwise Chief Investment Officer Matt Hougan has picked his four must-own crypto assets for this…

The Injective price isn’t moving quietly anymore. It just ripped 20% intraday, and no, this…

Ripple is no longer just a payments company. Through a series of aggressive acquisitions in…

While the broader crypto market has been rotating capital selectively this week, Trump-linked World Liberty…

IoTeX's cross-chain bridge was hit by a private key exploit on February 21, draining over…