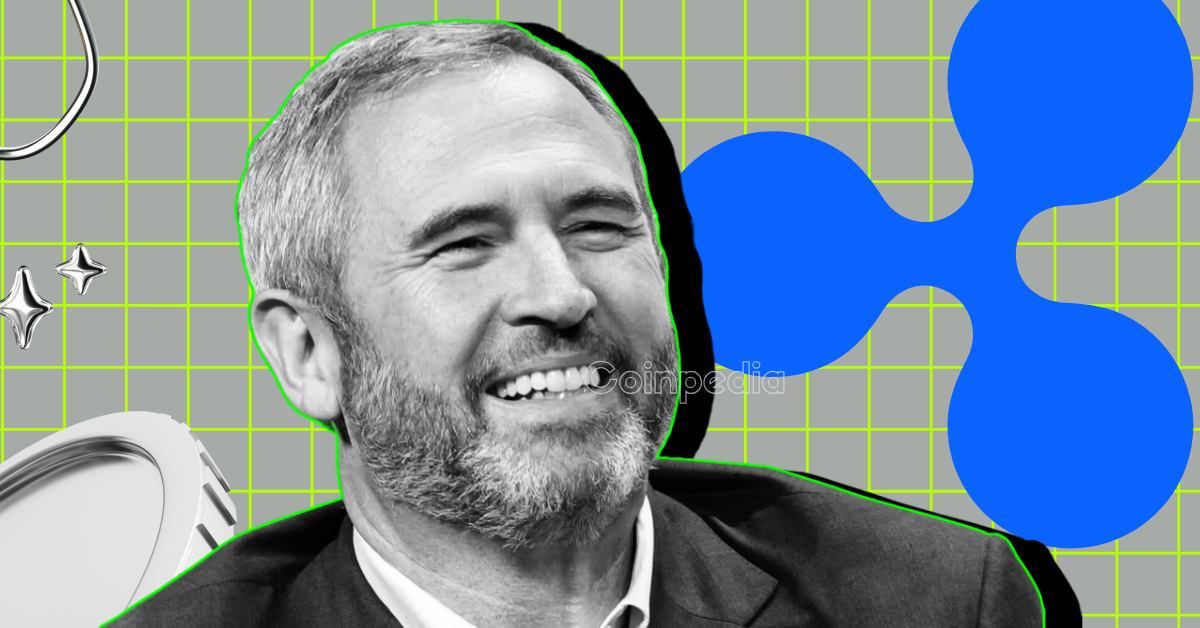

Ripple CEO Garlinghouse participated in Ripple’s “Crypto in One Minute” podcast, delving into the crypto-based exchange-traded funds (ETFs) just days after the historic launch of the first XRP futures ETF on Nasdaq.

His crisp, insightful remarks shine a spotlight on why crypto-based ETFs are catching everyone’s eye and why traditional finance is finally opening its doors to digital assets.

Garlinghouse identified two major drivers behind the growing excitement around crypto ETFs since their January 2024 debut.

First, institutional investors – from pension funds to endowments – have long struggled to access crypto assets directly. Before ETFs, they were stuck with cumbersome self-custody or relying on centralized exchanges, which limited their ability to trade crypto efficiently.

Now, crypto ETFs have smashed that barrier, enabling Wall Street heavyweights and financial institutions to seamlessly trade crypto. This newfound accessibility is a game changer.

Second, Garlinghouse argues that crypto ETFs are ‘institutionalizing the entire crypto industry’. He pointed to Bitcoin’s ETF as a historic example: it was the fastest ETF ever to hit $1 billion in assets and quickly soared past the $10 billion mark, leaving behind all other ETFs.

Garlinghouse predicts Bitcoin ETFs will eventually rival gold ETFs. Bold claim!

The launch of Volatility Shares’ XRP futures ETF on Nasdaq, under the XRPI ticker, marks a transformative step, following CME’s XRP-futures debut on May 19, 2025.

Just before a month of its launch, Teucrium’s 2x Long Daily XRP ETF and Bitcoin futures’ 2017 legacy underscore market maturation. Despite SEC delays, XRP’s resilience, recovering from $2.29 to $2.34, shows investors’ trust.

Garlinghouse’s sharp insights have ignited a buzz across social channels like X. Many praised his clear, concise take as the best one-minute crypto briefing around.

Users highlighted how institutional warming to crypto – especially XRP’s growing role in futures and ETFs – signals a broader shift. Conversations also touched on Bitcoin’s notorious volatility, Solana’s breakout potential, Pi token’s Kraken debut with 20x leverage, and JPMorgan’s recent stablecoin considerations amidst regulatory uncertainties.

As XRP hits new milestones and the crypto ETF market matures, Garlinghouse’s perspective underscores a transformative moment for institutional crypto adoption.

While regulatory roadblocks like SEC delays remain, XRP’s bounce-back, coupled with growing traction in Bitcoin and Solana markets, paints a interesting (and bullish) picture.

The SEC follows a lengthy review process (up to 240 days) for ETFs, involving public feedback and market data analysis.

Futures ETFs invest in contracts that bet on XRP’s future price, offering regulated exposure without holding the actual token. Spot ETFs, which are still pending, would directly hold XRP, providing direct asset exposure

Despite SEC delays, XRP recovered from $2.29 to $2.34, showing strong investor confidence and market resilience.

Yes, experts like Garlinghouse believe ETFs will fuel long-term crypto growth by attracting institutional capital and regulatory clarity.

Galaxy Digital Inc. (NASDAQ: GLXY), a financial investment firm focused on the crypto market, has…

Something big is happening at the crossroads of AI, blockchain, and public markets, and this…

Historical crypto charts indicate that small coins, costing less than a penny, often experience explosive…

The cryptocurrency world is buzzing with excitement as Ruvi AI (RUVI) gains momentum as a…

The cryptocurrency market is experiencing a pivotal moment as institutional money floods into digital assets…

Bitcoin is currently in a quiet phase. The price has been moving sideways without any…