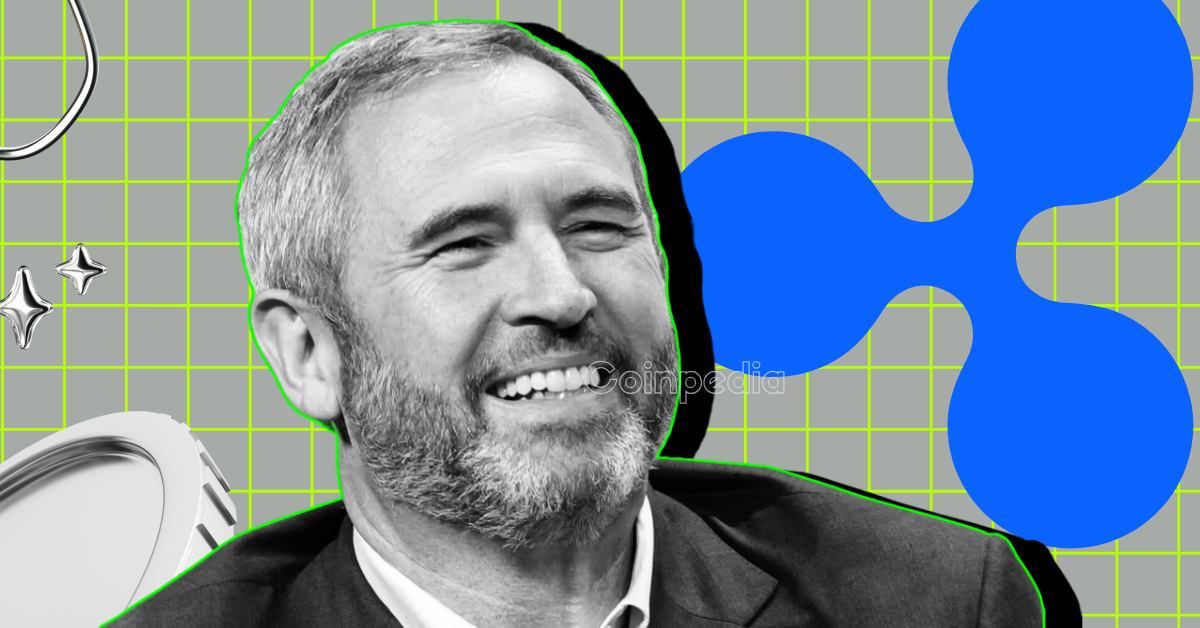

Ripple’s CEO Brad Garlinghouse is preparing to testify before the powerful U.S. Senate Banking Committee for the first time. On July 9, Garlinghouse and other top industry voices will share why the country urgently needs clear crypto market rules and what they believe lawmakers should do next.

In a recent tweet post, Garlinghouse announced that he feels honored to speak directly to lawmakers about why the U.S. needs proper rules for digital assets. Meanwhile, he thanked Senator Tim Scott, Senator Cynthia Lummis, and Senator Ruben Gallego for leading the way and supporting crypto-friendly rules.

He believes that strong but fair rules can protect everyday people and still let new ideas grow.

For years, Ripple and many other crypto companies have asked for clear laws that explain which digital coins are treated like stocks (securities) and which are seen as goods (commodities).

Right now, it’s often confusing for crypto companies to know which agency they should answer to the SEC or the CFTC.

Meanwhile, this hearing comes as Congress looks at three big bills: the CLARITY Act, the Anti-CBDC Surveillance State Act, and the GENIUS Act. Together, these could finally bring clear rules for how crypto companies, brokers, and exchanges work.

One of the biggest pieces is the CLARITY Act. It aims to settle the fight over whether the SEC or the CFTC should control different digital coins. Senator Tim Scott has hinted that this bill could even pass by October if all goes well.

Brad won’t be alone in this important hearing. Other speakers include Chainalysis CEO Jonathan Levin, Blockchain Association CEO Summer Mersinger, and a top Harvard expert.

They will share why smart rules matter and how they can help the U.S. stay ahead in the global crypto space. With clear rules, crypto companies can keep building and people can feel safer investing.

Ripple CEO Brad Garlinghouse is testifying to advocate for the urgent passage of clear crypto market structure legislation in the U.S. He aims to explain how robust yet fair rules can protect consumers, foster innovation, and clarify regulatory jurisdiction between agencies like the SEC and CFTC, which has long been a point of confusion for crypto companies.

Garlinghouse aims to advocate for the urgent need for clear and fair crypto market rules in the U.S. He will emphasize how proper legislation can both protect everyday investors and foster innovation in the digital asset space, pushing for clarity on whether digital assets are classified as securities or commodities.

Alongside Brad Garlinghouse, other prominent industry voices are scheduled to testify. These include Jonathan Levin, CEO of Chainalysis; Summer Mersinger, CEO of the Blockchain Association; and Dan Robinson, General Partner at Paradigm. They will collectively present the industry’s perspective on the importance of regulatory clarity for the U.S. crypto market.

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

While XRP now trades around $2.97 USD, traders are weighing Ripple’s legal timeline as closely…

The long-running debate over XRP’s decentralization has resurfaced, but this time, lawyer and well-known XRP…

Bitcoin has a way of moving in rhythms, and many traders are paying close attention…

I’ve been watching PancakeSwap closely since yesterday, and the CAKE price movements have been nothing…

When a whale moved 312,233 SOL into Coinbase Institutional, traders sat up straight. That is…

The SEC missed its Thursday deadline to decide on Canary Capital’s spot Litecoin ETF, with…