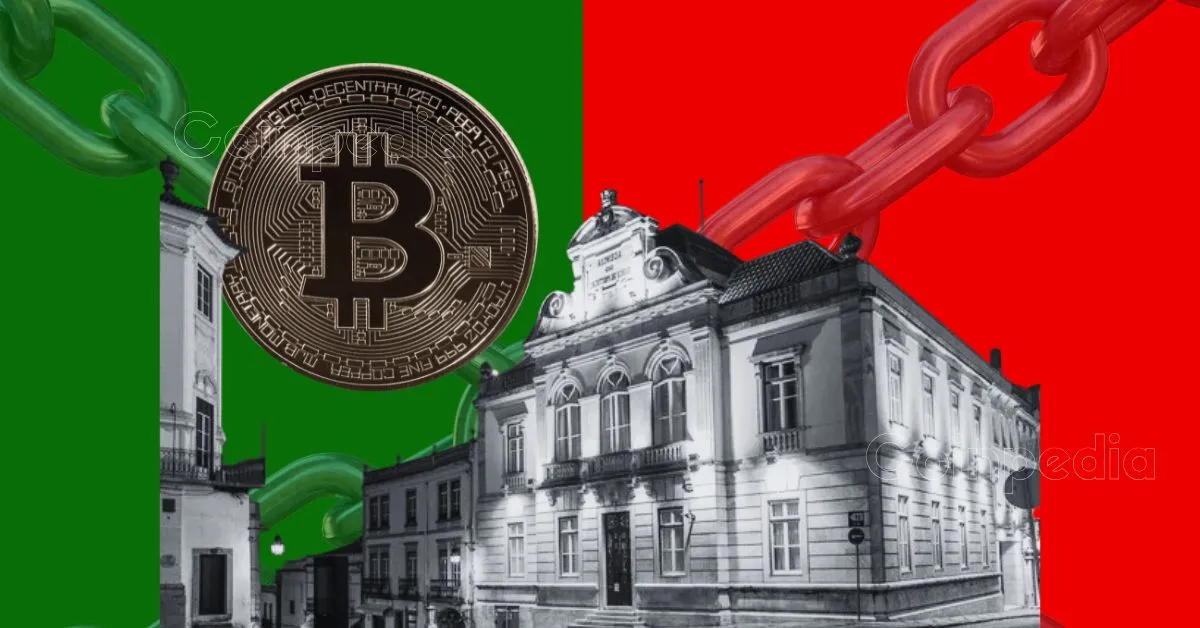

Portugal’s largest bank Banco de Investimentos Globais (BiG) has recently taken the step of blocking fiat transfers to cryptocurrency platforms, citing compliance with new European Union regulations. This marks a significant shift for Portugal, once regarded as a haven for crypto enthusiasts.

Why BiG Took This Step

BiG’s decision comes as European authorities, like the European Central Bank and the Bank of Portugal, increase their focus on anti-money laundering (AML) and counter-terrorism financing (CTF).

This move has raised concerns that Portugal’s restrictive approach could drive crypto investors to other countries, potentially impacting the nation’s economy. Interestingly, other Portuguese banks, such as Caixa Geral de Depósitos, still allow these transfers, making it clear that BiG’s decision is not yet a nationwide trend.

Portugal has been changing its stance on cryptocurrencies over the past few years. In 2023, it introduced a 28% capital gains tax on short-term crypto holdings—a sharp contrast to its earlier, more welcoming policies.

BiG’s move also aligns with the European Union’s new Markets in Crypto-Assets Regulation (MiCA), which aims to create uniform rules for digital assets across Europe. However, the situation highlights how even within the same country, banks can interpret these regulations differently.

Many in the crypto community worry that stricter rules like BiG’s could push users toward decentralized finance (DeFi) platforms. Portuguese crypto entrepreneur José Maria Macedo has warned that heavy regulation might drive crypto activity underground or onto DeFi platforms, where there is less oversight.

The introduction of new crypto taxes has only added to this concern, fueling fears that tighter controls could stifle innovation in the sector.

Diverse Approaches

Portugal’s evolving stance mirrors global trends. Countries like El Salvador have reduced their focus on cryptocurrencies due to economic challenges, while others, such as Switzerland and the Czech Republic, continue to embrace them.

Within the European Union, MiCA regulations offer some stability by ensuring that only compliant platforms can operate. However, BiG’s actions show how implementation can differ from one institution to another, even under the same framework.

BiG’s decision has sparked debates about the future of crypto in Portugal. While it unsettles the local crypto community, it may also drive more users toward alternatives like DeFi, encouraging further decentralization in finance.

Bitcoin may still be the king of crypto, but XRP is stealing the show this…

The LINK price has surged with renewed momentum, reacting to a blend of institutional partnerships,…

Story Highlights Binance Coin Price Today is . The BNB price prediction anticipates a potential…

Altcoins are making some major moves as several indicators point toward the long-awaited altcoin season.…

Story Highlights The live price of Ondo Price is Ondo price could reach a high…

Great news for all the memecoin enthusiasts out there. With a sharp breakout from a…