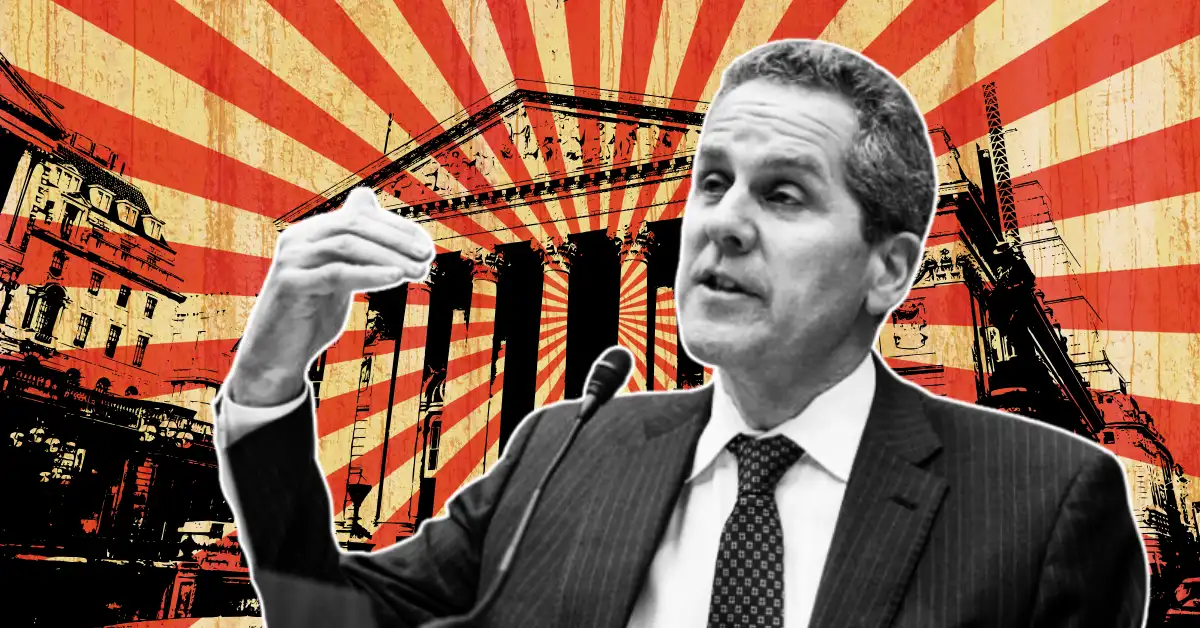

Michael S. Barr, Vice Chair for Supervision at the Federal Reserve Board, has announced that he will step down from his role on February 28, 2025, or earlier if a replacement is appointed. This unexpected announcement has sparked discussions about why he is leaving and how it could affect the financial sector.

In his resignation letter to President Joe Biden, Barr explained that his decision was motivated by a desire to avoid a lengthy legal conflict with former President Donald Trump

“It has been an honor and a privilege to serve as the Federal Reserve Board’s Vice Chair for Supervision, and to work with colleagues to help maintain the stability and strength of the U.S. financial system.”

Since his appointment in July 2022, Barr has played a key role in shaping U.S. financial regulations. He is known for his strict policies limiting how banks interact with cryptocurrencies, aligning closely with Senator Elizabeth Warren’s critical stance on the crypto industry.

Before joining the Federal Reserve, Barr held several prominent positions. He served as the Dean of the Gerald R. Ford School of Public Policy and as a law professor at the University of Michigan. He also worked at the U.S. Treasury Department and served as a clerk for a U.S. Supreme Court Justice.

Barr’s educational background includes degrees from Yale University and Oxford University, showcasing his impressive credentials.

Although Barr will stay on as a member of the Federal Reserve’s Board of Governors, his decision leaves an important role open.

With many changes happening in the financial world, including debates over cryptocurrency rules, his departure could impact the direction of future policies.

Barr’s departure marks the close of a critical chapter in U.S. financial oversight, leaving the path forward open to new possibilities and challenges.

The Bitcoin price is trading around $109,100, close to its recent peaks above $110,300, as…

President Donald Trump’s sweeping economic package, famously called the “Big Beautiful Bill,” has cleared the…

A Japanese-listed company, MetaPlanet, is preparing to launch Bitcoin-backed preferred stock. This new financial product…

Italy has established an organized framework for crypto regulations as part of the European Union…

The House of Representatives announced that the week of July 14th will be “crypto week”…

Pi Network’s native token, PI, is once again catching everyone’s eye as talk grows around…