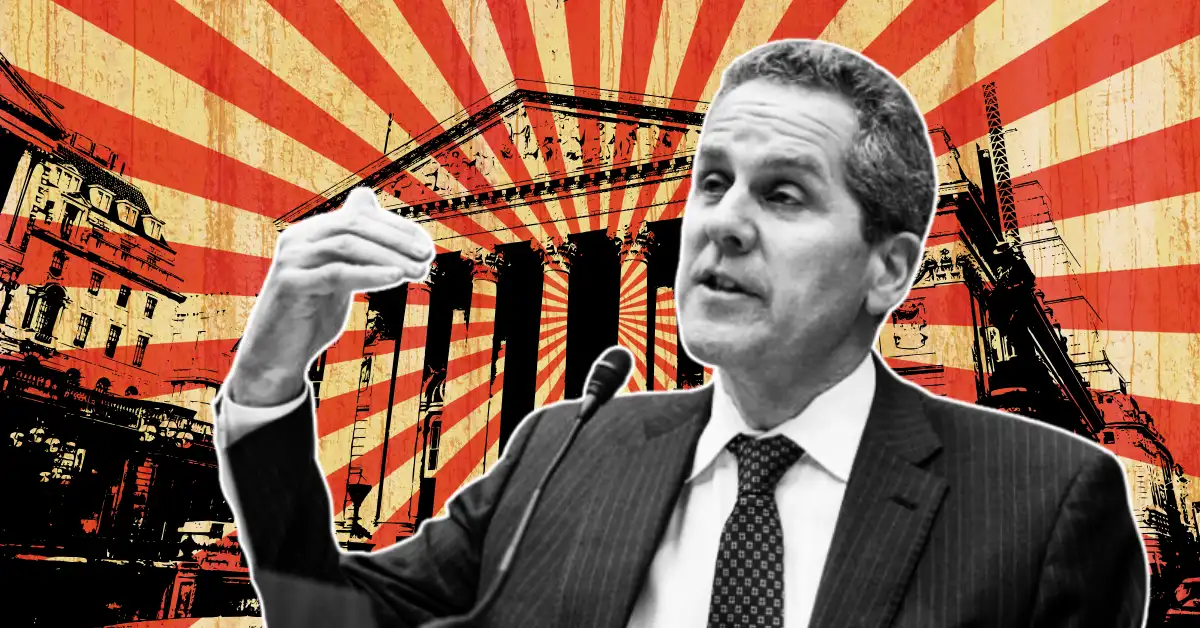

In a latest development, the Federal Reserve Board announced on Monday that Michael S. Barr will step down as Vice Chair for Supervision of the Federal Reserve Board. However, he will remain a member of the Board of Governors.

In a statement included in the Federal Reserve’s announcement, Barr suggested that he decided to voluntarily resign in order to avoid a potential dispute with the incoming Trump administration. Jaret Seiberg, a financial analyst at TD Cowen, warned that Barr’s resignation reflects growing political influence in banking regulation, as agency leaders no longer stay when administrations change, which inturn leads to more policy shifts.

The Fox Business Journalist, Eleanor Terett took to X and noting that Michael S. Barr was known for his close ties to Senator Elizabeth Warren and was seen as a key reason why banks have struggled to engage with and hold crypto assets.

Barr had significant influence on the financial system’s relationship with cryptocurrencies. While he had prior experience with crypto, including advising Ripple, his tenure has been controversial for the crypto industry. He advocated for the Federal Reserve to regulate and enforce laws on stablecoin issuers in the U.S., a move that has faced criticism from Republican lawmakers.

Notably, Senator TimScott criticized Michael Barr for failing to oversee the safety of the banking system, citing his role in the Spring 2023 bank failures and the problematic Basel III Endgame proposal. “I stand ready to work with President Trump to ensure we have responsible financial regulators at the helm,” he noted.

Michael Barr had planned to serve until 2026, but his resignation raises uncertainty around a key proposal requiring major U.S. banks to hold more capital to prevent future crises. Barr played a crucial role in the proposal, which aims for a 19% capital increase for big banks like Citigroup and JPMorgan. The banking industry has strongly opposed this plan.

As Bitcoin and Ethereum fuel the resurgence of Altcoin Season 2025, investors are scanning the…

Dogecoin millionaire who turned four figures into millions returns with new meme coin prediction. Which…

XRP is holding on to recent gains after a decent move over the weekend. The…

Since Bitcoin’s launch more than a decade ago, centralized exchanges have promised speed, efficiency, control,…

Bitcoin has been breaking new highs lately, and President Donald Trump is all in. Once…

Cardano has been flashing strong accumulation signals lately, but so has PEPE. And while both…