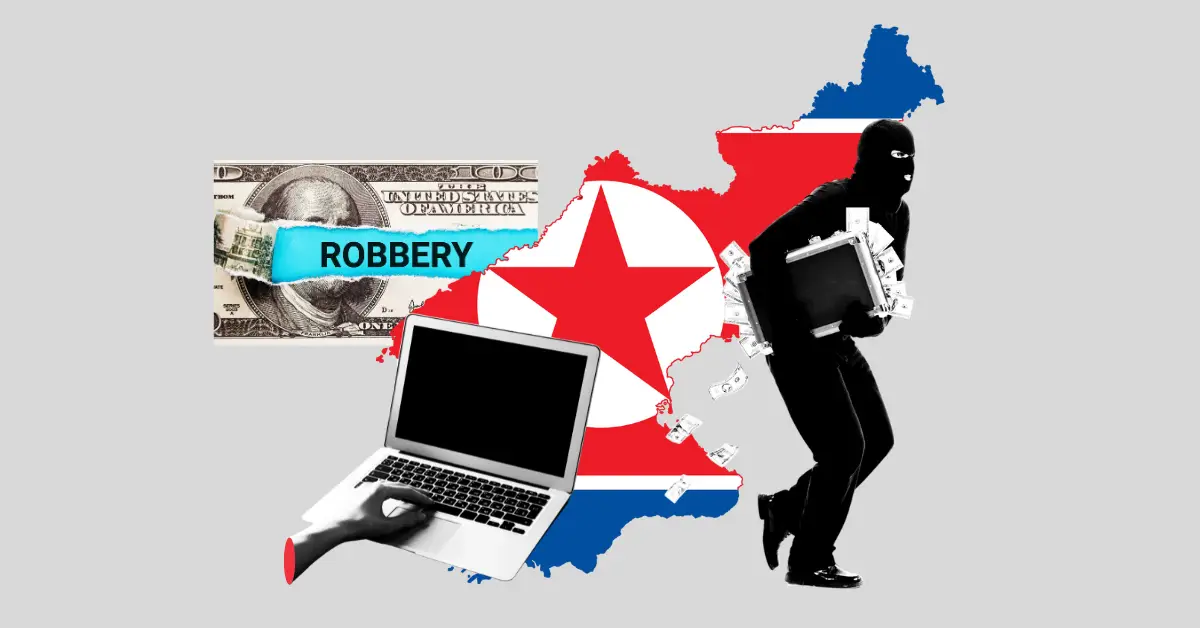

North Korea has quietly built one of the largest government-held Bitcoin reserves, surpassing even crypto-friendly nations like El Salvador and Bhutan. This has raised concerns in the crypto community, as a sudden sell-off from North Korea could shake the market, causing a liquidity crisis and a major price drop.

What happens if they decide to sell off their holdings? Could this trigger a massive market crash? And more importantly, is this part of a bigger geopolitical game?

Here’s a closer look at how North Korea built its Bitcoin empire – and why the world should be paying attention.

North Korea’s rise as a major Bitcoin holder follows a large-scale cyber heist by the Lazarus Group, a state-backed hacking syndicate. On February 21, 2025, the group stole over $1.4 billion in cryptocurrency from Bybit, a well-known exchange. Much of the stolen funds, originally in Ethereum, were later converted into Bitcoin, increasing North Korea’s total holdings to 13,562 BTC—now valued at more than $1.14 billion.

While North Korea has acquired Bitcoin through cyberattacks, the United States has opted for a structured approach. On March 6, 2025, President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve (SBR). With 198,109 BTC, worth around $16.71 billion, the US now holds the world’s largest government-owned Bitcoin supply.

According to Arkham data, several governments now hold significant amounts of Bitcoin:

The timing of North Korea’s Bitcoin buildup, just as the US launched its Strategic Bitcoin Reserve, has raised speculation. Some analysts believe Kim Jong Un is using stolen Bitcoin to create a shadow reserve, helping North Korea bypass financial restrictions and fund operations without relying on traditional banking systems.

Bitcoin’s decentralized nature makes it a valuable asset for North Korea, which has been cut off from the global financial system due to international sanctions. Unlike traditional reserves such as gold or foreign currency, Bitcoin allows the country to move wealth and conduct transactions without oversight from global financial authorities.

While the US sees its Bitcoin reserve as a financial strategy, North Korea’s growing stash appears to be part of a broader geopolitical game. This marks a shift where digital assets are becoming tools of economic and political influence.

The crypto community is increasingly worried about North Korea’s Bitcoin strategy.

Some believe it is a direct challenge to US dominance, while others warn that if Washington does not act, more countries may follow similar tactics.

Bitcoin is no longer just a currency; it’s a weapon, a shield, and a statement of power.

Ever since the Fed's rates were slashed below 5% back in October 2024, they have…

Bitcoin (BTC) price has gradually lost its initial July bullish momentum during the past three…

Solana (SOL) is navigating a pivotal market phase as it hovers near a critical resistance…

The Federal Reserve has decided to keep its key interest rate steady at around 4.25%-4.5%,…

Litecoin (LTC) price has shown renewed momentum in recent sessions, staging a steady upward move…

Pump.fun’s native token, PUMP coin, is currently trading near $0.0026, following a volatile post-ICO phase.…