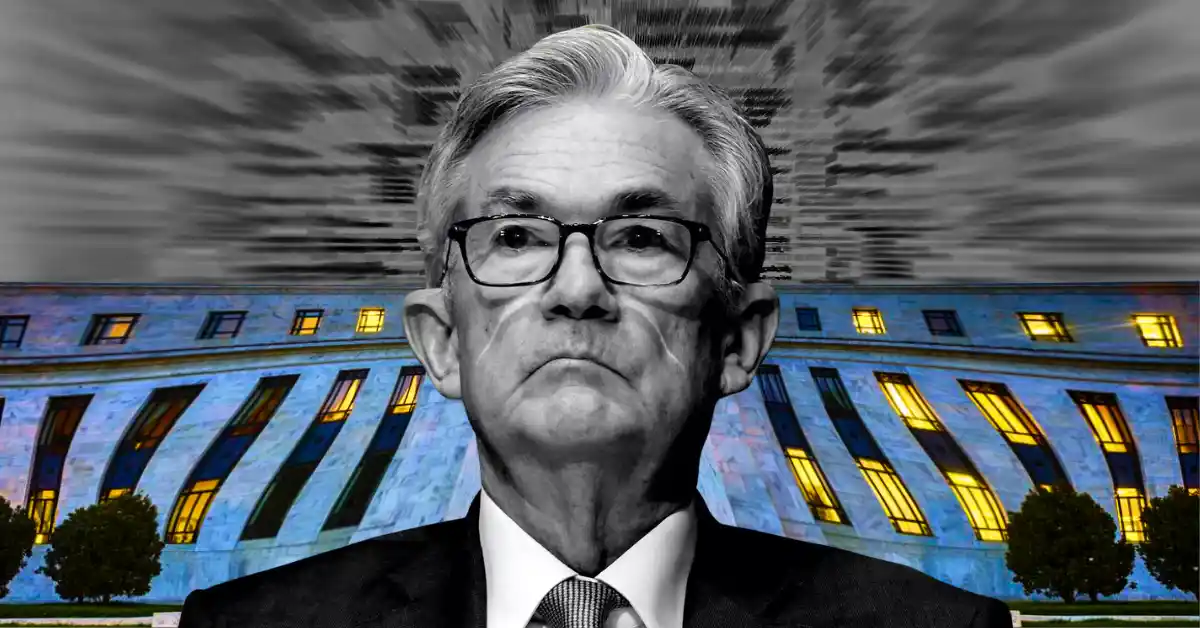

Federal Reserve Chair Jerome Powell has strongly defended the central bank’s independence amid a new Justice Department investigation. Speaking over the weekend, Powell argued that the probe reflects political pressure from the Trump administration over interest rate decisions, rather than concerns about the Fed’s renovation project.

According to Powell, the controversy is not about a building renovation, but about whether the Federal Reserve can continue setting monetary policy based on economic data rather than political demands.

The investigation, launched by the U.S. attorney for Washington, D.C., focuses on renovations to the Federal Reserve’s headquarters and whether Powell misled Congress about the project’s cost and scope. Reports say the inquiry began last week, immediately drawing attention due to its political backdrop.

Powell emphasized accountability, stating that no public official is above the law. However, he described the criminal probe as “unprecedented” and said it should be seen in the context of repeated White House pressure aimed at influencing interest rate decisions.

President Donald Trump has frequently criticized Powell for keeping interest rates higher than desired, arguing that cuts are needed to support economic growth. Trump has also threatened to remove Powell and previously attempted to fire Fed Governor Lisa Cook over unrelated issues, a move later blocked by the Supreme Court.

When asked about the investigation, Trump denied involvement but still questioned Powell’s leadership, including both his monetary policy decisions and handling of the Fed’s renovation project.

Powell warned that the inquiry raises a larger concern: whether U.S. monetary policy will continue to be guided by economic conditions or be subject to political influence. His term as Fed chair ends in May, adding urgency to the debate over who will shape the next phase of U.S. interest rate policy.

Reports suggest Trump is considering several loyalists to replace Powell, including Kevin Hassett, a top economic adviser. While Hassett supports aggressive rate cuts, he has stated that the president’s views would not directly dictate policy decisions.

The administration has already influenced the Fed’s direction by appointing Stephen Miran, a Trump ally, to the board last year. At his first policy meeting, Miran called for a 0.5% rate cut, signaling a potential shift toward a more politically aligned central bank.

As the Jerome Powell investigation unfolds, markets are closely watching developments. The outcome could define Powell’s legacy and the future independence of the Federal Reserve itself.

The race to the $1 mark has always been the ultimate dream for crypto enthusiasts.…

February 23, 2026 05:18:04 UTC Why is Bitcoin Dropping? Bitcoin price crashed more than 5%…

Global cryptocurrency markets fell sharply on Monday, extending a multi-month downturn that traders say is…

Missouri lawmakers are advancing legislation that would allow the state to establish a Bitcoin Strategic…

Story Highlights The price of the Meme Ai token is . MEMEAI trades near $0.00005890,…

Story Highlights The live price of the Zcash token is Zcash price could see a…