Today isn’t just another Federal Reserve meeting, it might set the tone for how crypto moves in the coming weeks. Most experts believe that the Fed will keep interest rates unchanged at 4.25% to 4.50%.

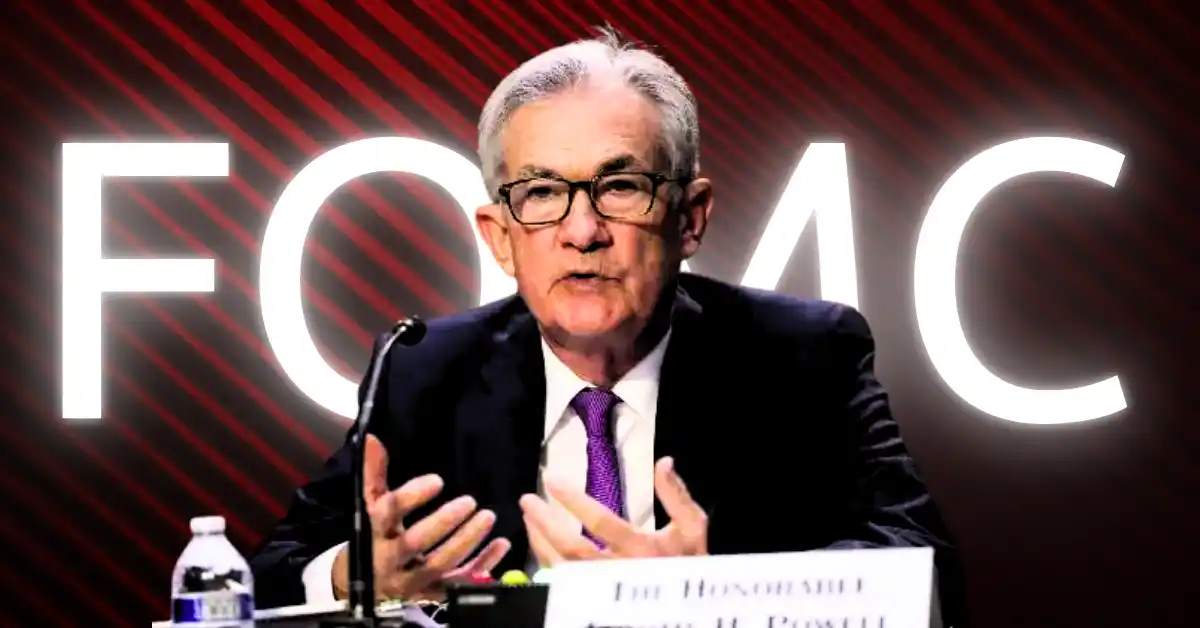

However, U.S. President Donald Trump has added a twist. He’s putting strong pressure on Fed Chair Jerome Powell to either cut rates or step down, making today’s meeting even more important for the crypto market.

The Federal Open Market Committee (FOMC) meets eight times a year to decide whether to raise, lower, or keep interest rates unchanged. This time, most investors expect no changes.

Even according to the CME FedWatch Tool, there’s a 97.9% chance that rates will remain steady.

Holding rates has helped control inflation, which currently sits at 2.7%, still above the Fed’s target of 2.0%. So, from a policy view, the pause makes sense.

Meanwhile, the real attention is on what Fed Chair Jerome Powell will say during his press conference.

A softer, “dovish” tone from Powell could surge risky assets like Bitcoin and Ethereum. It would suggest that the Fed may start cutting rates sooner, possibly as early as September.

But if Powell sounds more serious or “hawkish,” hinting that rate cuts will be delayed, it could bring short-term pain to the crypto market. But if Powell avoids mentioning future cuts, traders may lose confidence, and Bitcoin could fall by 5% to 10%.

As of now, Bitcoin is trading in a tight range between $115,000 and $118,000. But that could change fast depending on Powell’s message.

On top of the Fed drama, another big announcement is also expected today, a major policy report from the President’s Working Group on Digital Assets. If it supports crypto growth and clearer regulations, it could give Bitcoin and Ethereum an extra boost.

With rising political pressure, especially from Trump, there’s speculation that Powell may resign soon. If true, today’s meeting could be his last major move. He might try to leave a lasting mark by signaling that rate cuts are coming, possibly starting in September.

Still, for now, he seems firm on holding rates steady. But one unexpected word from Powell today could shake the entire crypto market.

After a few unsuccessful attempts, the Solana price hits the $90 threshold, raising bullish possibilities…

Why is Bitcoin up today? Because the same whales who watched retail traders panic sell…

As the cryptocurrency market continues to evolve, more investors are asking an important question: How…

[KAI Exchange Official Announcement] Regarding the online rumor on March 1 about "a second-hand French…

Bitcoin climbed over the past 24 hours, raising a question across the market: how high…

Iran’s crypto market, worth about $7.8 billion, is seeing a sharp rise in activity as…