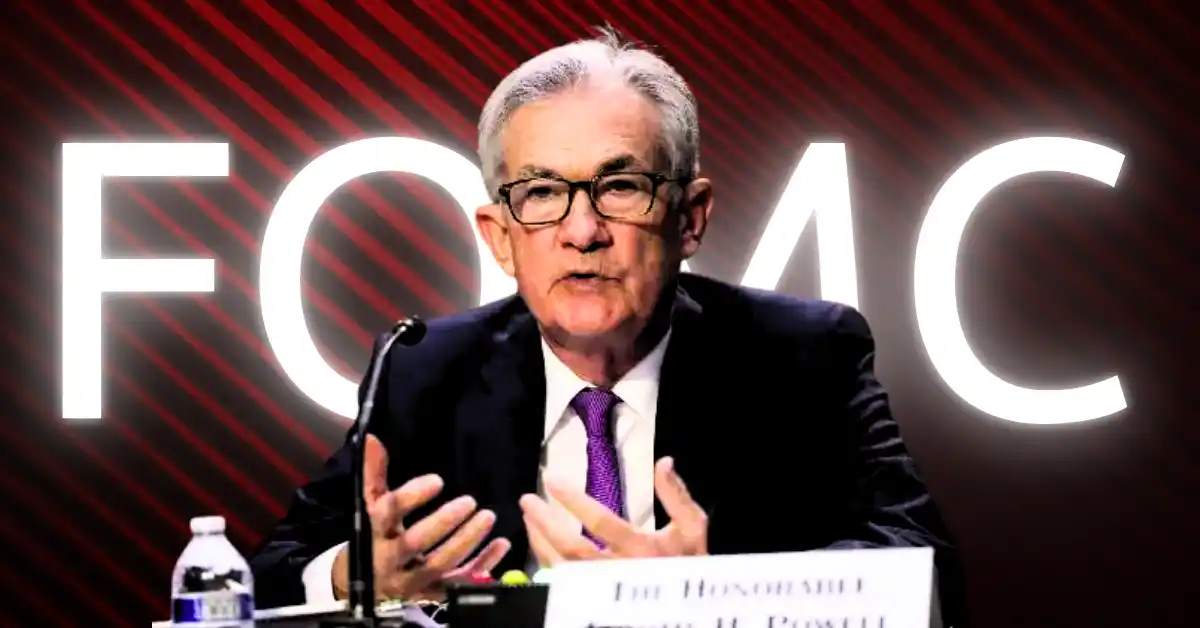

The Federal Reserve has decided to keep its key interest rate steady at around 4.25%-4.5%, holding firm despite pressure from President Trump to cut rates. Fed Chair Jerome Powell said the central bank might have lowered rates further, but Trump’s broad tariffs created economic uncertainty, making officials more cautious about additional rate changes.

On Wednesday, July 30, the U.S. Federal Reserve decided to keep interest rates steady at 4.25%–4.50% for the fifth straight time, matching what most analysts expected. The announcement came shortly after President Trump once again urged Fed Chair Jerome Powell to cut rates.

Before the decision, markets showed modest gains, with the Dow up by 0.06% and the Nasdaq rising 0.5%. The 10-year Treasury yield climbed to 4%, and the Dollar Index rose to 99.4.

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the FOMC statement said.

Fed Chair Jerome Powell and other officials say they’re waiting to see how President Trump’s import tariffs affect inflation and the overall economy. Prices on items like appliances, furniture, and toys have gone up, and inflation has ticked higher, but not as much as some predicted.

By holding off on a rate cut, the Fed is likely to face more pressure from Trump, who has been pushing for lower borrowing costs and greater influence over the central bank.

Following the news, the crypto market didn’t react much, with Bitcoin price consolidating around the $118K level.

Story Highlights The live price of Kava crypto is . In 2026, KAVA could attempt…

India’s Delhi High Court has refused to regulate cryptocurrency exchanges in India, making it clear…

The debate around Bitcoin’s long-term outlook is intensifying once again. While some investors view the…

Chainlink price is up nearly 4% today, rebounding alongside a stabilizing broader crypto market, but…

The XRP price is compressing around an important support range, which it defended during the…

On February 24, Bitcoin spot ETFs recorded strong inflows totaling $258 million. Fidelity’s FBTC led…