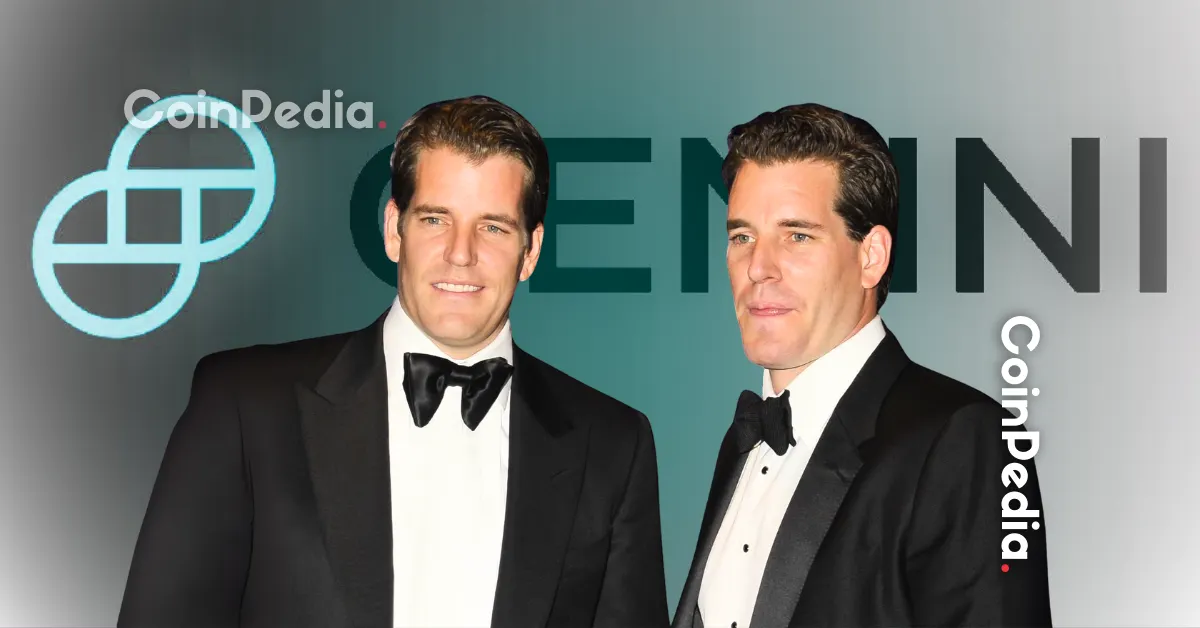

The world of cryptocurrency just welcomed another big moment as Gemini, the exchange led by Cameron and Tyler Winklevoss, made its debut on Nasdaq. The listing, under the ticker GEMI, raised $425 million and instantly positioned Gemini among the most prominent public crypto firms.

On its debut, Gemini priced its IPO at $28 per share, selling around 15.2 million shares. The stock, however, opened much higher at $37.01, giving the firm a valuation of nearly $4.4 billion.

Interestingly, Nasdaq itself became part of the story by investing $50 million in Gemini’s stock through a private placement. The move not only showed confidence in Gemini but also signaled a deeper partnership between traditional finance and the crypto sector.

Additionally, the company and its stockholders gave underwriters a 30-day option to buy 750,000 extra shares. Gemini clarified it won’t earn from shares sold by stockholders.

Despite going public, the Winklevoss brothers are not losing their grip on the company. According to filings, they will retain about 94.5% of Gemini’s voting power, ensuring they remain firmly in control of the exchange’s direction.

The IPO also included 10% allocations for insiders and long-time & up to 30% for retail traders through platforms like Robinhood, SoFi, and Webull, a rare move that gave everyday investors a chance to participate early.

Gemini now joins Coinbase and Bullish as one of the few U.S.-listed crypto exchanges. It also follows recent public debuts by Circle, Figure Technologies, and eToro, highlighting a wave of crypto-native firms tapping into U.S. capital markets this year.

The timing looks favorable. With friendlier regulatory signals and growing interest in digital assets, more crypto companies are seizing the opportunity to raise funds and expand.

While the IPO was a financial success, Gemini still faces challenges. The exchange posted a net loss of $283 million in the first half of 2025, following a $159 million loss in 2024.

Despite these numbers, investors seem optimistic that Gemini’s brand, partnerships, and position in the U.S. market will drive long-term growth.

The man who built the first stablecoin thinks AI agents are about to change how…

The AAVE price didn’t just bleed today but it absorbed a double hit. First came…

Tokenized Gold Safe Haven 2026 isn’t just a catchy phrase infact it’s the plot twist…

Nearly $5 billion in Bitcoin left major exchange wallets in just 30 minutes on Saturday,…

As the crypto market crash today deepens amid rising global war tensions, geopolitical instability, and…

February 28, 2026 11:37:06 UTC Saudi Arabia Signals Readiness to Back US as Regional Tensions…