Bitcoin has had a rough month, dropping about 9.7% and trading nearly 30% below its all-time high. For many, this might seem like a setback – but some experts see it differently.

Crypto analyst Axel Adler Jr. believes Bitcoin is gearing up for a strong recovery. In a recent post on X, he pointed out that corporate investors are quietly buying, long-term holders are accumulating, and selling pressure remains low. But if that’s the case, why isn’t Bitcoin soaring yet?

Adler says the answer lies in macroeconomic challenges. However, he also suggests that one key shift – whether from the Federal Reserve or the Trump administration – could send Bitcoin surging by 50% in the near future.

Could this be the start of Bitcoin’s next big rally? Let’s take a closer look.

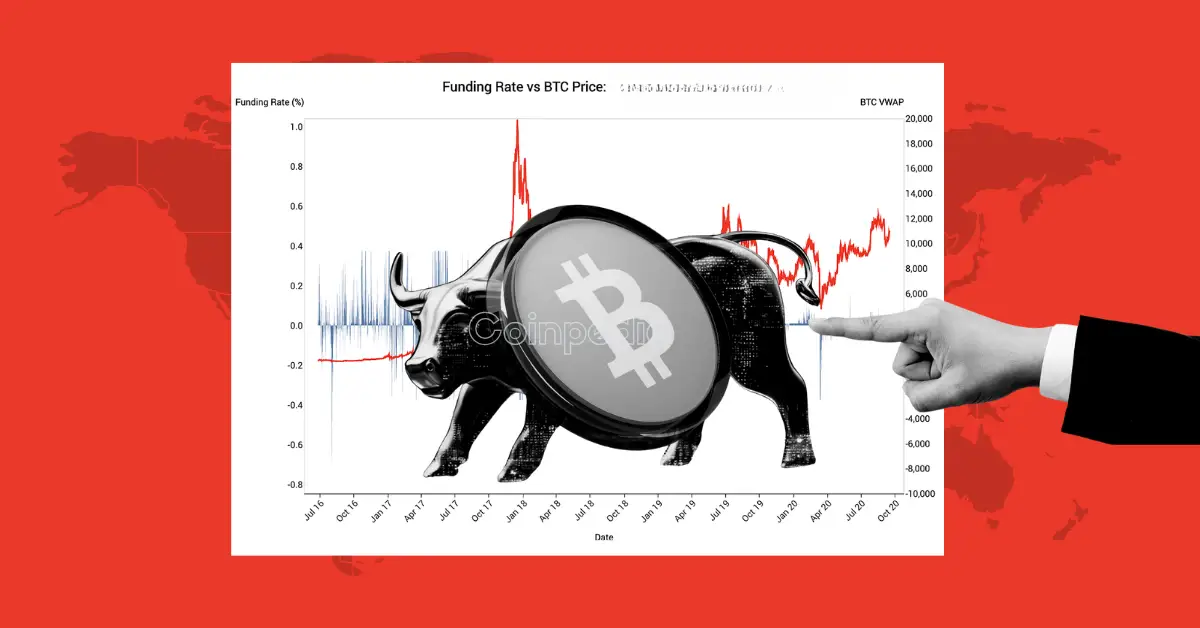

According to Coinalyze data, the Bitcoin funding rate has dropped below zero on several major exchanges.

However, on other platforms like Huobi, Kraken, OKX, and Woo X, the funding rate has risen above zero:

Adler pointed out that similar funding rate patterns have appeared five times in previous Bitcoin cycles. Four of those times, BTC saw a price surge, while once, the market declined.

He remains optimistic, emphasizing that corporate investors are still buying, long-term holders are accumulating, and experienced traders have stopped selling. On-chain data also suggests that the market is stabilizing after a period of overheating.

While Adler acknowledges that weak macroeconomic conditions are a challenge, he believes a policy shift could trigger a major bull run. He predicts that Bitcoin could reach $130K dollars, especially if the market attracts more institutional investment through ETFs.

With increasing investor interest and possible policy changes ahead, the next few weeks could be crucial for Bitcoin’s price movement.

Bitcoin’s next big move might not be far away – whether it’s a breakout or a bust, the market is gearing up for something big.

Bitcoin funding rates drop when short positions outnumber longs, signaling bearish sentiment or market uncertainty among traders.

Analysts suggest Bitcoin could hit $130K if institutional investment rises and regulatory policies favor crypto adoption.

Projecting a 10-year growth in a volatile asset like Bitcoin seems a far-stretched notion. The BTC price is expected to cross $600,000 by 2030. With global adoption, Bitcoin could be worth 1 million dollars.

Solana (SOL) price has entered a crucial sell wall between $170 and $203, which has…

Ethereum (ETH) showed signs of cooling volatility after failing to break above the $4,000 resistance…

As Bitcoin and Ethereum fuel the resurgence of Altcoin Season 2025, investors are scanning the…

Dogecoin millionaire who turned four figures into millions returns with new meme coin prediction. Which…

XRP is holding on to recent gains after a decent move over the weekend. The…

Since Bitcoin’s launch more than a decade ago, centralized exchanges have promised speed, efficiency, control,…