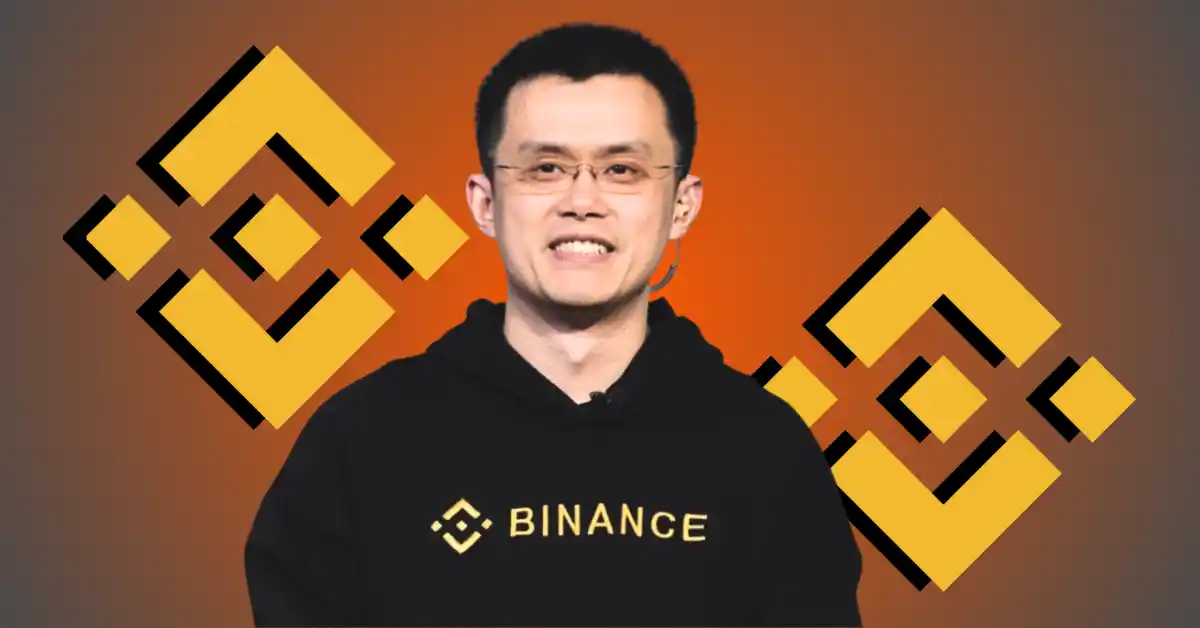

Binance founder Changpeng Zhao

The chaos began when CZ shared an educational video about the BNB Chain, featuring a token called Test (TST) as an example. This led to the creation of a TST meme coin, which saw a surge in trading despite CZ having no direct involvement. Meanwhile, another meme coin named BROCCOLI took off after CZ mentioned his dog’s name, fueling speculation.

Initially, these tokens experienced 50% gains—BROCCOLI, for example, jumped 160% at launch. However, the rally was short-lived. Both tokens crashed by more than 60-80% in just days, triggering panic among traders who had jumped in hoping for quick profits.

CZ announced that he would donate funds to affected investors, encouraging others to contribute as well. He also personally donated 150 BNB (around $100,000) to a university student who had already put $50,000 toward helping victims of another failed crypto project, Libra.

However, he made it clear that his donations do not mean he supports these tokens.

“I won’t be keeping a satoshi of it. Will donate it away, most likely to people who had a loss on TST or some of the Broccolis,” he wrote on X.

He also warned investors against reading too much into his actions, reminding them that speculation often leads to losses.

CZ recently completed his four-month prison sentence on September 27, 2024, and is now working to rebuild his public image. His decision to compensate affected investors could be a strategy to shift the focus away from past controversies.

At the same time, CZ has been focusing on new investments and launching his digital education platform, Giggle Academy, which aims to teach newcomers about crypto investing.

CZ’s response highlights the unpredictability of meme coins. He also pointed to the LIBRA token, which surged and then collapsed after being linked to Argentina’s President, Javier Milei.

Crypto expert Clayton Lowery warns that many new tokens are created just to make quick money before disappearing. Data from Chainalysis shows that in 2024, over 400,000 tokens were launched in just one month, but only 1.7% are still actively traded.

This means most tokens either fail or are abandoned after the hype fades. Lowery also points out that 94% of suspected pump-and-dump tokens were scams where creators took the money and ran, while 6% were manipulated by insiders.

While many meme coins are driven by hype, some projects aim to build real value through community engagement and useful features. Experts advise investors to research projects carefully and look for tokens with real-world applications, rather than chasing quick profits.

The cycle repeats: hype, surge, crash—who will learn before it happens again?

The prices of top cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and XRP showed little to…

Ever since the Fed's rates were slashed below 5% back in October 2024, they have…

Bitcoin (BTC) price has gradually lost its initial July bullish momentum during the past three…

Solana (SOL) is navigating a pivotal market phase as it hovers near a critical resistance…

The Federal Reserve has decided to keep its key interest rate steady at around 4.25%-4.5%,…

Litecoin (LTC) price has shown renewed momentum in recent sessions, staging a steady upward move…