After months of meticulous research and planning, Sharky ($SHARK) protocol, the first escrow-less and leading NFT lending platform on the Solana (SOL) ecosystem, successfully conducted its Token Generation Event (TGE) on Tuesday, April 16, 2024. The distribution of $SHARK tokens took place on the Jupiter Exchange, with priority being given to its OG user base and various Solana communities, such as Madlads and MonkeDAO.

Following the successful TGE, the $SHARK token was listed on two major cryptocurrency exchanges including Bybit and MEXC, with more listings in the pipeline. On Bybit Exchange, withdrawals of the $SHARK token begin on April April 17, 2024. Notably, Bybit Exchange has planned two special events with a total prize pool of 514k $SHARK tokens both for new and existing registered users on the trading platform.

Similarly, the MEXC cryptocurrency exchange has set aside 50k USDC for the $SHARK airdrop with eligibility criteria depending on MX token holding.

Meanwhile, Meteora protocol, a Solana-based liquidity provision platform, announced a four-week 50k USDC incentive program for the liquidity providers for the SHARK/USDC pool. Notably, Meteora protocol is currently running a pilot program with the Gauntlet platform to drive deeper liquidity for tokens launching on Jupiter Exchange LFG launchpad.

Part of the goal for the Meteora incentives is to make it easier for LPs to participate on launch day and manage their IL from day 1 volatility and beyond. As of this report, the SHARK/USDC pool has around $155,926 in total value locked (TVL) – consisting of 325k SHARK and 10,236 USDC – and managed over $3.5 million in trading volume.

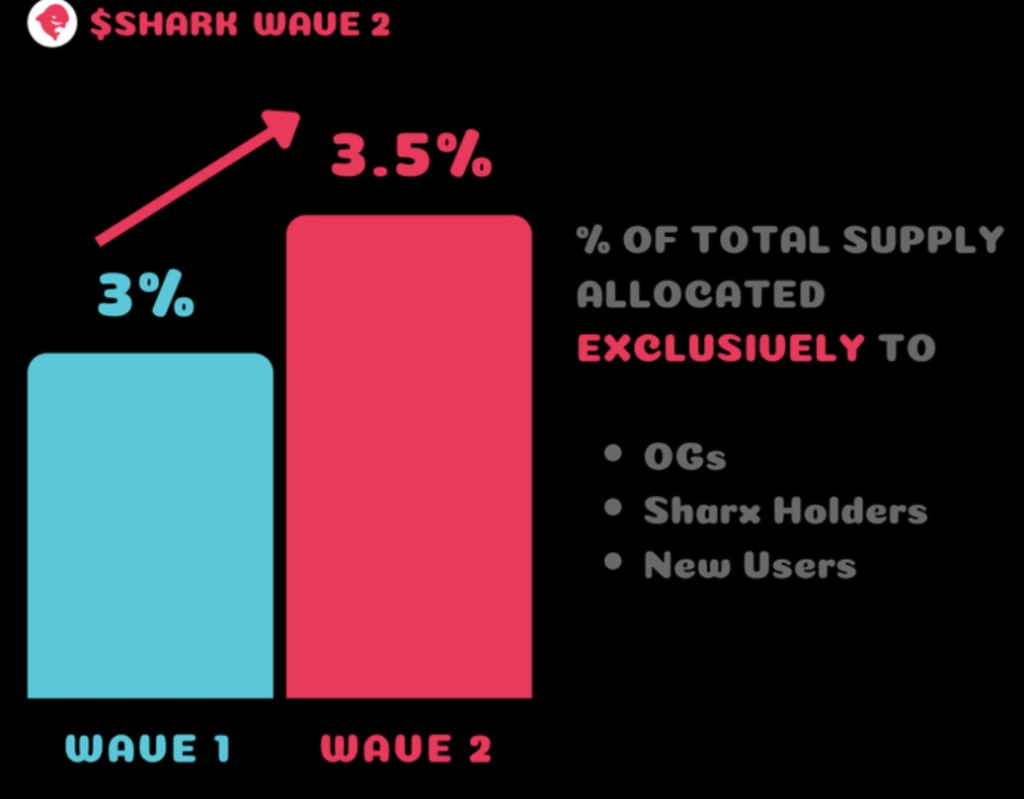

The $SHARK tokens have a total supply of 100 million, thus a fully diluted valuation of about $48 million as of this report. The $SHARK distribution process will involve two waves in a bid to reach more users over time. The first wave of the $SHARK token distribution involved 4.25 percent of the total circulating supply.

Out of which, 1.2 percent was allocated to the OG platform users, 1 percent was allocated to the Sharx NFT holders, and 0.8 percent was assigned to new users during the farming season. Notably, the Monke and Mad Lads communities were allocated 1 percent of the total $SHARK’s circulating supply. The remaining 0.25 percent of the wave 1 $SHARK allocation was assigned to Zealy participants, with the top 2,000 of the leaderboard given priority.

As for the Wave 2 $SHARK token distribution, the Sharky protocol assigned 3.5 per cent of the total circulating supply for the OG users, new users, and Sharx NFT holders. According to on-chain data provided by Solscan, the $SHARK token has a total of more than 8.4k holders.

Notably, trading of the $SHARK is ongoing on the Orca DEX through the USDC and WSOL liquidity pools.

Meanwhile, the Sharky platform introduced the exclusive staking pool for the airdrop participants only, with lockup duration of between 30-60 days. According to the announcement, Sharky’s OG users, new users as well as the Sharx NFT holders can stake their $SHARK tokens to get more than 100 percent daily distribution.

The Sharky team is committed to the long-term prosperity of the NFT lending business in the Solana ecosystem. Furthermore, none of the team allocations of $SHARK tokens were sold during the TGE. Additionally, the Sharky platform team announced that $SHARK token holders who opt to lock up their tokens will be rewarded for their loyalty.

Story Highlights The live price of SUI crypto is . SUI shows strong bullish momentum…

On March 6, the Florida Senate unanimously passed Bill 314, which details comprehensive regulations regarding…

Following a three-day streak above $70K, Bitcoin (BTC) has fallen below this resistance level, trading…

Bitcoin just broke through $73,500 for the first time in a month, significantly outperforming gold…

It is one of the oldest questions in crypto: when prices fall and the headlines…

The XRP price is once again flirting with a familiar setup shrinking exchange supply and…