The rise of copy trading platforms and trade copiers has given asset managers and professional traders new ways to scale their strategies across dozens (or even hundreds) of client accounts. But while many solutions promise automation, the real test comes down to performance: how fast trades replicate, how reliable the system is under stress, and whether it holds up when scaled beyond a handful of accounts.

This article benchmarks Finestel, a pioneer in all-in-one SaaS platforms for asset managers. Instead of a feature rundown alone, we put the system through a lab-style test, measuring latency, replication drift, order fill variance, and dashboard responsiveness. The results show how well the software holds up when pushed under real-world conditions.

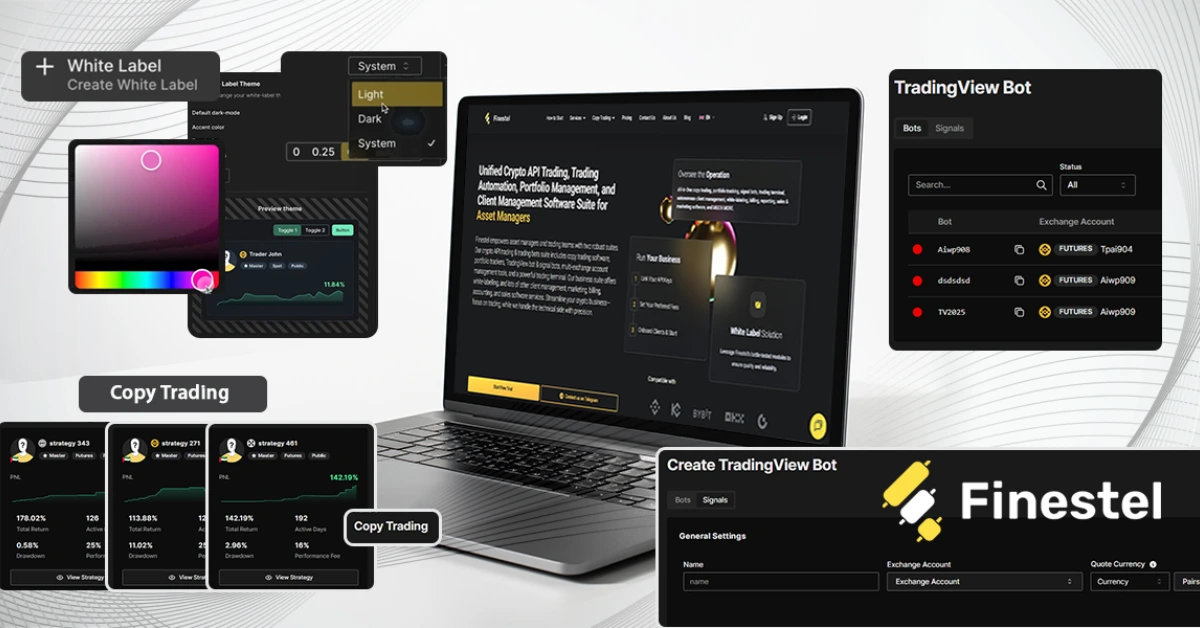

Before diving into benchmarks, it’s worth explaining what Finestel is and why we chose it for this review. Unlike single-purpose bots or lightweight retail copy-trading apps, Finestel was one of the first platforms designed as an all-in-one SaaS system for more professional traders and asset managers in crypto & forex, who try to manage multiple accounts and clients. As they mentioned,

The platform combines:

Because it positions itself as a professional-grade trade copier and client management stack, Finestel is a natural candidate for benchmarking. The promise of being able to scale from ten accounts to hundreds is compelling, but it’s only credible if the performance data backs it up.

For professional traders and asset managers, latency and reliability are not optional. A delay of even one second in a volatile crypto market can mean slippage that erodes client trust. Similarly, a copier that fails under throttling conditions can lead to inconsistent performance across accounts.

Benchmarking trade copiers offers two benefits:

We structured the benchmark like a controlled experiment, designed for reproducibility.

Pass/Fail Criteria (Based on the Test Data):

Copy Latency

Order Fill Variance

Replication Drift

Dashboard Responsiveness

Uptime Snapshot

Overall: All benchmarks passed within professional thresholds.

The test results suggest a few key takeaways:

Benchmarks only make sense when viewed against the broader landscape. Many copy-trading solutions work well with a handful of accounts but begin to degrade once scaled beyond 50. Common issues include:

By contrast, the benchmarked results show that Finestel maintained low latency, minimal drift, and responsive dashboards even at 200 accounts under stress. This doesn’t mean it’s flawless, but it suggests the platform’s architecture was built with scale in mind—something lightweight, retail-focused copiers typically don’t address.

From a purely technical perspective, Finestel clears the benchmark across latency, drift, order variance, and uptime. But benchmarks are not static—they matter most as the industry evolves. With forex integrations (MT4/MT5) underway, the same questions of replication speed and stability will soon apply across both crypto and traditional markets.

For asset managers, this kind of testing isn’t just about validating a single product—it’s about de-risking growth decisions. Moving from 20 to 200 clients requires confidence that the underlying infrastructure won’t buckle under stress.

Our verdict is simple: Finestel passes today’s benchmarks, and it sets a high bar for what trade copiers need to deliver as portfolios and markets diversify.

XRP price started the session on a strong note, pushing quickly to an intraday high…

Bitcoin is showing signs of stabilization after weeks of volatility, raising a major question across…

Story Highlights The price of the Livepeer token is . Livepeer (LPT) price prediction 2026–2030:…

Bitcoin traded mostly flat over the past 24 hours, posting only a small increase after…

XRP is showing fresh momentum in the crypto market, rising about 5% in the last…

Bitcoin climbing back above $70,000 has clearly lifted sentiment across the crypto market. With confidence…