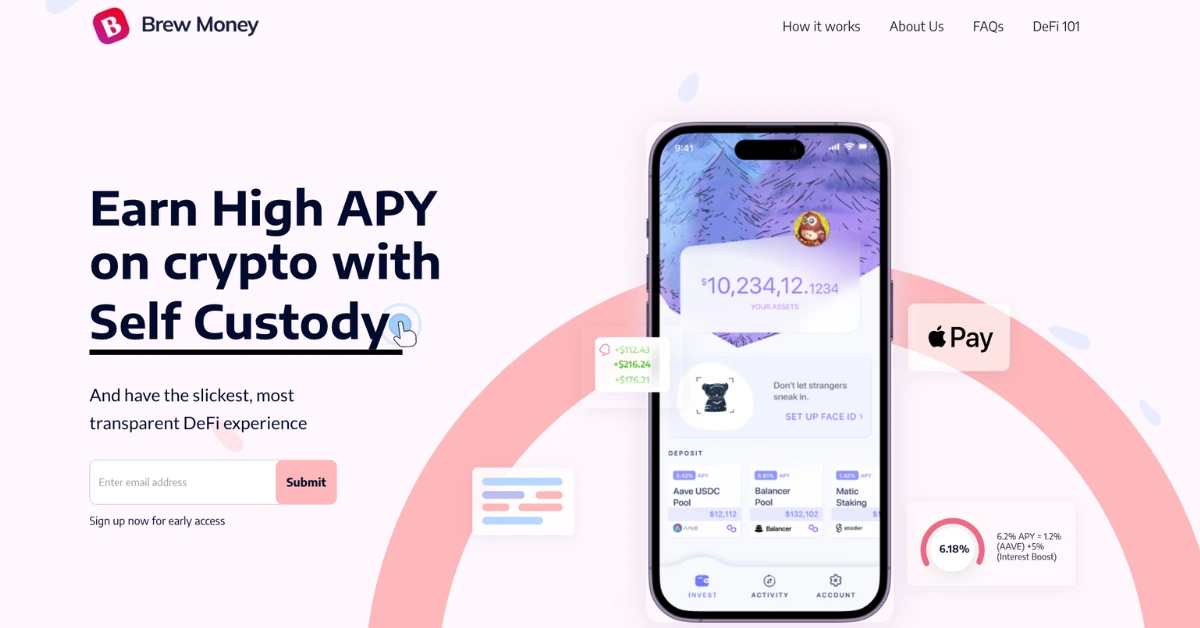

Brew Money is a non-custodial wallet in form of a mobile app. It lets its users invest in multiple blue-chip DeFi protocols like Aave and Balancer & earn up to 10% APY in one single click.

Decentralized Finance (DeFi), a blockchain-based ecosystem, offers its users an array of financial services such as lending, borrowing, trading, etc. However, the existing routes to take advantage of the high APYs in DeFi are complicated for the average consumer. It is both time-consuming and expensive.

The digital wallet,Brew Money, has simplified this process of leveraging DeFi protocols through its platform, enabling users to start earning 10% APY in just a few steps.

Step 1: Users can start by making instant deposits on the app using Apple Pay with ZERO fees.

Step 2: The funds are then directly converted into stablecoin (USDC) and deposited into Blue-Chip DeFi Protocols such as Aave and Balancer.

Step 3: Users start earning up to 10% APY instantly & can see their money growing in real-time on the app.

Brew Money is in Beta right now.

Early adopters are receiving an exclusive NFT from their Aaveians Collection minted to celebrate Brew’s Beta Launch. Join the Waitlist now!

Considered to be the future of finance, Defi’s growth is triggered by a number of advantages, including the elimination of service fees charged by intermediaries. DeFi runs on smart contracts that provide intermediary-free services.

A smart contract is a computer program that automatically directs, controls, or records legally important events as per an agreement. It eliminates the need for a third party, enabling a trustless system. Once deployed, altering a smart contract is not possible.

Brew Money’s newsletter publication DeFi Fridays publishes such educational content on DeFi every week. From the meaning of APY/APR to the ‘Blockchain Trilemma’ and fun news like Rick & Morty’s connection to decentralization, they cover it all. Have a look at their recent post here.

Brew Money’s co-founders, Archisman Das and Mehul Marakana, both alumni of Practo, come with a strong product and technology background. A mutual interest in crypto and Decentralized Finance led them to join forces and launch Brew Money in late 2021.

They aim to empower consumers to seamlessly leverage the advantages of the DeFi ecosystem and grow wealth. The platform is built on top of polygon (an L2 solution atop Ethereum) and backed by Accel, Better, Polygon’s Co-Founder Sandeep Nailwal, and is an AAVE Grant recipient.

“Traditional financial systems, by design, prevent millions of consumers from getting access to financial opportunities. We believe that the future of banking will be built on top of Cryptocurrencies and DeFi Protocols.

However, in its current form, DeFi is too expensive and complex for a common person to participate in. Our platform enables users to get more value for their wealth through simplified access and a superior user experience,” said Mehul Marakana, co-founder of Brew Money.

“At Brew Money, we’re committed to building a product that helps users access DeFi in a safe, secure, and scalable manner. We are backed by some of the best investors in the startup and crypto ecosystem and are integrated with audited and safe protocols such as AAVE and Balancer. We’re on our way to integrating more such stable protocols in the future and making it a valuable experience for users,” said Archisman Das, co-founder of Brew Money.

Users of Brew Money can earn up to 10% APY on their deposits through multiple Blue-Chip DeFi protocols with ease. Join the waitlist now.

Follow them on their Twitter handle (@brew_defi) to stay in sync with the DeFi ecosystem.

The guest posts featured on Coinpedia are contributed by external authors and reflect their personal opinions and viewpoints. Coinpedia does not endorse, verify, or take responsibility for the accuracy, legality, or reliability of the content, advice, or opinions expressed in these guest posts. Including guest posts does not imply Coinpedia's approval of the content or the author’s views. Readers are encouraged to independently evaluate the information and seek professional advice if necessary before acting on any information provided in the guest posts.

Crypto analyst Ran Neuner said he would choose PENGU over XRP as a better altcoin…

Wintermute’s data shows that as macro uncertainty returned and altcoin momentum faded, positioning steadily rotated…

Crypto rotation has already begun ahead of Q2 2026. Traders are watching large caps that…

Utility tokens are all the rage in the crypto world right now. With institutional interest…

XRP is once again in the headlines. The token has analysts arguing how far it…

SUI Price Prediction is back in focus this week as the wider market flips risk-on…