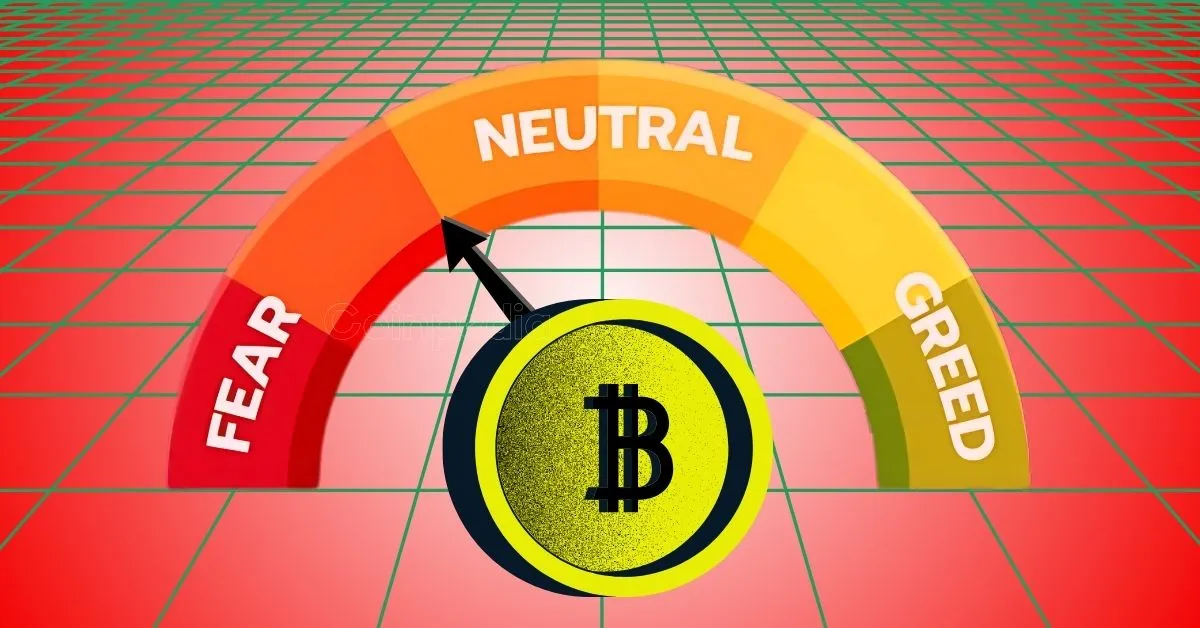

The Crypto Fear and Greed Index fell to extreme fear levels of 5-9, the lowest since the June 2022 Terra and FTX crashes, as Bitcoin briefly dropped below $65,000 before recovering. The cryptocurrency saw a single-day decline of over $10,000, wiping out significant market value and triggering widespread liquidations. U.S. spot Bitcoin ETFs recorded $434.1 million in net outflows on February 5, led by BlackRock’s IBIT, reflecting growing caution among institutional investors.

On Thursday, crypto investigator ZachXBT published an exposé in which he accused employees at Axiom…

The Trump-backed Bitcoin miner, American Bitcoin Corp. (NASDAQ: ABTC), has today revealed a 159% year-on-year…

A fresh discussion is taking place in the XRP community: Is the Canton Network quietly…

Trading activity around XRP has picked up sharply, with new data from Bitrue showing a…

Aave, the DeFi lending platform founded by Stani Kulechov in 2020, has surpassed $1 trillion…

Story Highlights The live price of the Avalanche is . Price predictions for 2026 range…